MBPN Participates in “35 Hours of Giving” Campaign for Endowments

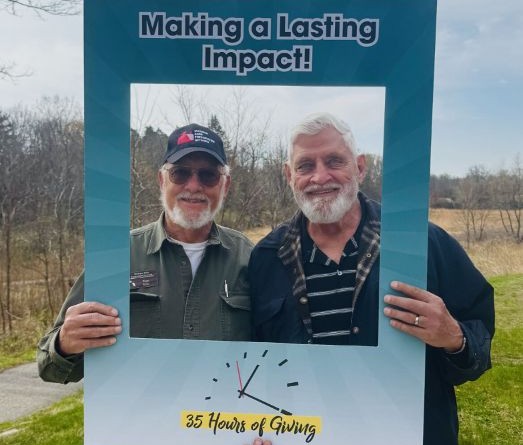

Tom Irrer, MBPN president, and Clare Koenigsknecht, treasurer & past president, thank donors for supporting the giving event hosted by the Capital Region Community Foundation, the holder of our endowment, held May 7 & 8.

“MBPN’s aim is to inspire barn owners and Michigan communities to save one more barn. Securing our rural legacy will always be a continuous process. Thus, the importance of our Endowment Fund,” says Tom.

“We can admire the skill and craftsmanship of our traditional barns, or we can lament the loss of barns. OR, we can look ahead and show how barn owners are keeping their barns alive for future generations!”

Please consider supporting the endowment.

On a Mission to Save Barns and Promote Preservation

Head out on any road in Michigan for a leisurely drive and you won’t go far without encountering a sadly-neglected barn. Losing too many of these symbols of our great agricultural heritage is a reality of our changing economy and changing culture. That is one reason it is so gratifying to be a part of a team that seeks out and recognizes success stories.

Barn preservation is at work in Michigan, and MBPN is at the forefront of that movement. We can all be proud of the little part we play in inspiring someone to save that barn.

Keith and Linda Anderson are Sparta, MI farmers with two award winning barns. Keith is a MBPN board member and committee chair for the Barn of the Year awards.

MBPN shows how it’s possible to repair and adapt historic structures

Our family invests both time and money in the Michigan Barn Preservation Network because we want outreach, information and awareness around saving and preserving traditional barns to be available and continue into the future. Twenty – thirty – fifty years from now MBPN’s work will keep many barns both visible and useful – whether for agricultural use or adapted for business, homes, nonprofit and community gathering or recreational places.

Steve Stier, current head of the Technical Committee, answers questions and helps owners find knowledgeable and experienced barn workers for their projects. He is also a MBPN founding member and past president.

Julie Avery, MBPN vice president, serves as Endowment co-chair.

ENDOWMENT FUND ESTABLISHED

Preserving Our Heritage – Investing in Our Future

The Michigan Barn Preservation Network has established an endowment fund at the Capital Region Community Foundation. Both current and deferred gifts to this endowment can provide you with a tax reduction and help ensure that the Michigan Barn Preservation Network will benefit generations to come.

Gifts to the Endowment Fun will secure our future by expanding our ability to:

- Demonstrate, educate and promote best practices in barn preservation

- Enhance and increase statewide outreach and communication, and

- Strengthen MBPN’s infrastructure and effectiveness

We invite you to help support our work! Our goal is an endowment fund total of at least $500,000.

Contact our treasurer, Clare Koenigsknecht, at clarek13@gmail.com

How Does an Endowment Work?

When someone makes a gift to the MBPN Endowment Fund it is permanently invested to grow over time. Earnings from the fund are used to support the mission and outreach of MBPN.

Why make an endowed gift?

Because endowments are permanent, the Fund benefits our mission and our community forever. Endowments are invested for growth over time, and while the principal is never used, earnings are available to MBPN each year for the important work of our organization. Endowments provide a dependable, perpetual source of funding.

Tax Considerations

MBPN is a 501 ©3 charitable organization. Your donation to our endowment fund may reduce your tax obligation.

If you are 70 ½ or older, an IRA charitable gift roll-over to a charity (up to $100,000) is free from federal income tax. Also known as a Qualified Charitable Distribution, an IRA rollover gift qualifies for your required minimum distribution, permitting you to lower your income and taxes for the year while supporting a 501 ©3 charity or nonprofit organization.

Gifts to us or to the Capital Region Community Foundation in our name are tax-exempt. Contributions of appreciated property can be deducted at their full market value. Appreciated assets given to a fund at the Community Foundation are free of capital gains taxes. No tax is owed on the growth of assets in our endowment fund.

Always review tax advantages with your accountant and attorney when considering charitable giving.

The Capital Region Community Foundation manages the MBPN Endowment Fund along with 400 other charitable funds created by individuals, families, businesses and organizations.

Having the MBPN Endowment Fund at the Community Foundation gives donors confidence that their gifts will be well managed financially, with a consistent focus on growth of principal and generation of income for our use.

Address: Capital Region Community Foundation, 330 Marshall St, Suite 300, Lansing, MI 48912

Contact the Foundation at (517) 272-2870. More information at: https://ourcommunity.org/

The Michigan Barn Preservation Network, founded in 1995, is a 501(c)(3) charitable organization, qualified under Section 170 of the Internal Revenue Service Code to receive gifts, grants, and contributions which are deductible for United States federal income tax purposes.

For more information about making a direct gift to MBPN or through the Capital Region Community Foundation, contact our treasurer, Clare Koenigsknecht, at (989) 593-2351 or Julie Avery, Endowment Chair, at (517) 927-1958.

Click to print out MBPN Endowment flier and Pledge Form.